A Written Monthly Budget

We don't hear about this enough I think. A monthly budget should be apart of every household and I would even be bold enough to suggest that budgeting should be in the school curriculum. Millennials these days have literally no idea how much money is leaving their accounts each month. Counterintuitively, they always seem to know when, and by how much, they are paid each month.

Don’t believe me? Try asking a millennial how much they got paid last month. Most will be able to tell you the exact number, sometimes to the penny (or cent). Now ask them how much they spent last month. They may even grace you with a blank stare before reposting, “I don't know exactly how much but I know I'm okay.” This is exclusive evidence that millennials know how to spend money blindly but no idea how to budget.

Health warning: Asking someone about their wage is considered rude in Britain.

I would also ask you the same thing. Do you know how much is going out? Are you forever getting surprise overdraft fees and bouncing payments?

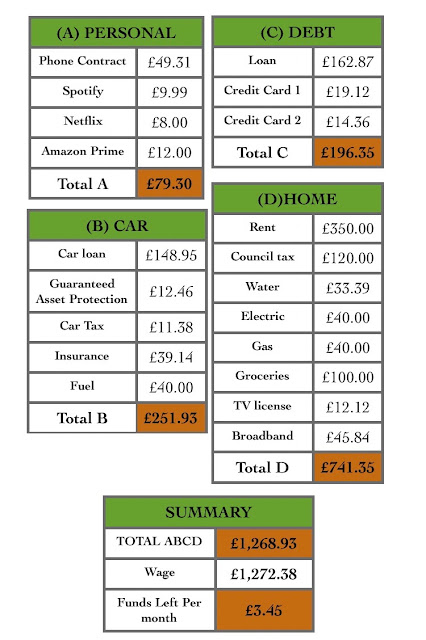

Well, get your glasses on and get a calculator ready because Im going to show you a remarkable spreadsheet.

*

Welcome, to the biggest mind-f**k in personal finance history.

Some quick points before we continue:

- The monthly wage is based on the UK minimum wage (£7.83) at 37.5 hours a week.

- This is based on a working person living alone.

- The Orange cells are calculations, white cells are inputs.

- You will notice five (5) categories:

- Personal

- Car

- Debt

- Home

- Summary

- None of these figures, for the record, have anything to do with my own finances.

Now, lets take a look into these categories.

A) Personal

When doing your own monthly budget, it is important to find every single penny (or cent) that leaves your bank account and add it to this column. If you find that you spend £28.43 on take-away coffee each month then write it in. This spreadsheet is, first and foremost, a shock and awe exercise.

Most people have a mobile phone on contract. I wont get into the details about smartphones in this blog but that may be a subject later in the year. Let it be said though, most, if not all, millennials have a smartphone today. At the time of writing, a brand new iPhone 8 64GB in a standard colour costs £699 (over $900 US). Who’s got that kind of money to buy a smartphone outright?

Spotify, Apple Music, Netflix, Amazon Prime and others have one thing in common. You don't own anything. You pay for the privilege of downloading as much or as little as you like when you like. These streaming services are more and more common but they come at a price. They might not seem expensive but once you add them all up you might be amazed how much you are spending.

B) Car

This has been given its own column because its financial impacts are mind-boggling. In a few weeks time I will be discussing car financing with you all. As an ex-salesman for Ford, I can give you an honest inside look at car financing, however, today we will be taking a more generic look.

A car payment of £149 is not expensive but its important to show it. Guaranteed Asset Protection (aka: GAP Insurance) is an additional and optional insurance which, in my previous professional opinion, is vital for car finance. Thats not an elevator sales pitch, its a realistic requirement.

For non UK readers: Car tax, insurance, additional insurance and loan details will vary dramatically in Europe and in the US.

Car/Road tax and Car Insurance are required by law and can be paid as a single yearly payment or on a monthly basis. Road tax is based on how much CO2 your car creates. Insurance is ‘car specific’ here in the UK.

You must take a detailed look at your car spending, especially if you are financing a vehicle, because it will be a real eye-opener when you see the total box at the bottom.

C) Debt

Yes, Im sorry, we have to talk about debt.

Personal loans are too easy to secure in Britain and can make life harder and not easier. Our ‘modern’ culture gives us permission to take out loans to pay for weddings, televisions, holidays and pretty much anything we can't or won't save for.

I know several people, myself included until recently, who have two credit cards. One of which is usually a 0% transfer credit card which is a great way to offset debt and not pay any interest, but only if you’re using it to pay off as much as you can.

The two payments in the debt column (£19.12 and £14.36) would be a typical ‘minimal payment’ which only covers the months interest and not the credit itself. In other words, you wont be making any progress in clearing your credit card debt.

Add all your debt payments up and be amazed!

D) Home

This should be self-explanatory. Your basic household bills. Add these up to include your rent/mortgage, utilities, groceries, internet usage and anything else orientated around the home.

I don't have children, but if I did I would include childcare and other expenses here in the home column.

In this example I have priced the rent at £350 per calendar month which is a very cheap, one bedroom flat (or ‘apartment’ to my american cousins). A decent sized two bedroom house with a garden would be closer to £700 per calendar month.

The Summary

Time to be very afraid. Only 3 cells are required here: the total expenses for all four categories, the monthly wage not including any overtime or bonuses, and the funds remaining cell.

It is important to include the first cell because you need to be shocked by how much money is leaving your account. As said previously, the wage in this example is based on an average working week with a minimum wage. The funds remaining is simply the 2nd cell minus the first cell and this is the cell which will make you take massive action.

Go back and look at the spreadsheet again. None of the figures here are over-exaggerated and are based on normal UK living. If this doesn't make you want to start writing up a budget right now then either you have more money than you know what to do with or you are frightened by what you will find.

If you are frightened, good, get on with it. You must find out where you are going wrong and/or where you can save money to pay off debt quicker and start saving some money.

Comments

Post a Comment